April 30, 2020

New Federal Tool for Calculating APRs

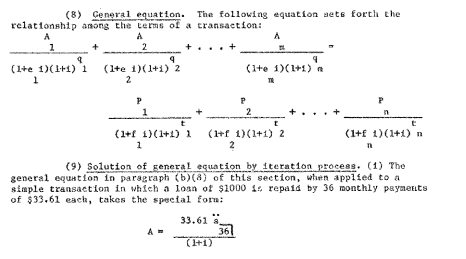

You're probably scanning this and thinking, "math, formulas, time to skip this article." I don't blame you. For anyone who has actually looked at Regulation Z's Annual Percentage Rate formulas and felt that queasy "I'm in the wrong math class" sort of feeling, you're not alone. Back in 2005, when I was a second-year law firm associate, my mentor tossed me a copy of the formulas to see if I could help a client. This is the first formula, and I'm not joking when I say that they only get more complicated after this one:

Having been taught that there's nothing a lawyer can't invest the time to learn in order to help a client, I had to swallow my pride (it tastes like tears), and admit that avoiding complicated math formulas like this one was the reason I went to law school in the first place. As I contemplated bribing a math professor neighbor of mine, my mentor laughed and casually mentioned that a federal agency (the Office of the Comptroller of the Currency) publishes a calculation tool I could use instead. By the way, it was then that I realized that, one day, I too could enjoy some real sadistic fun as a law firm partner.

So, I found the OCC's website and downloaded its nifty calculator, called APRWIN. Named for its accessibility on a Windows-based operating system, APRWIN was a joyful departure from my normal work researching and deciphering federal and state lending regulations.

I still have a copy of APRWIN downloaded on my computer, and through the years, I've used it more times than I can count. But, for really complicated data, I've worked regularly with an APR expert, Cliff Cook (no relation to Robert Cook) of Compliance Services Group. Cliff has helped me understand novel calculations (often involving bizarre consummation timing scenarios) and helped clients with their POS calculations directly too.

APRWIN is the predecessor to a new tool for calculating APRs, that was released on April 16th by a collection of federal regulators called the Federal Financial Institutions Examination Council's (FFIEC). You can find the new calculator here: https://www.ffiec.gov/examtools/FFIEC-Calculators/APR/#/accountdata.

In discussing this new calculation tool with Cliff, he cautions users not to delete APRWIN just yet. His concern is that there could be some unanticipated bugs in the new calculation tool, especially when it comes to transactions where monthly (or semi-monthly) payments are due on the last day of the month. I haven't encountered those types of bugs yet, but I have already noticed some differences, both good and bad.

The first difference is that, unlike APRWIN, you can't download the new calculation tool onto your computer; instead, you have to use it right on a federal regulator's website. That difference makes me a bit nervous because the tool also includes a field for the lender's name and the borrower's name. That's confidential information that I'm not comfortable dropping into any website, particularly a regulator's website. Of course, users can easily sidestep this problem by using dummy information.

Another difference-and helpful update to APRWIN's capabilities-is that the new calculation tool promotes the ability to look at unique calculations, such as the "military annual percentage rate" and construction loan APRs. Those types of calculations historically required additional steps after using APRWIN to perform some initial calculations.

In addition, users will find that the calculation tool's results page simply looks different. It appears to include the same information, but doesn't provide it in a clean, simple box, the way APRWIN did. While it isn't difficult to decipher the results on the new platform, the old boxed format was easy to copy, paste, and send to clients, so they could easily see their APR problems.

Lastly, there's a link called "help" on the new tool, much like APRWIN included a help tab. The new tool seems to include all of the information that was provided under the APRWIN "help" tab, along with some updates. The updates include a 41-page document with several complicated formulas. The formulas seem to apply to various payment scenarios, but seem as complicated to me as the formulas in Regulation Z. If I need to resort to reading those, I'll probably call my friend Cliff.

All-in-all, it appears that the new calculation tool provides some helpful updates and new features not offered by APRWIN. But, as with APRWIN, it will almost certainly not take the place of capable experts who can examine particularly complicated calculation scenarios on a transaction-by-transaction basis. I can't wait to ask one of my newer colleagues to figure out those new formulas for me.